File 2290 Form Online for 2023-2024

Tax Period

Simple, Quick & Secure Filing

- Get your Stamped Schedule 1 in Minutes

- Guaranteed Schedule 1 or your Money Back

- Free VIN Correction

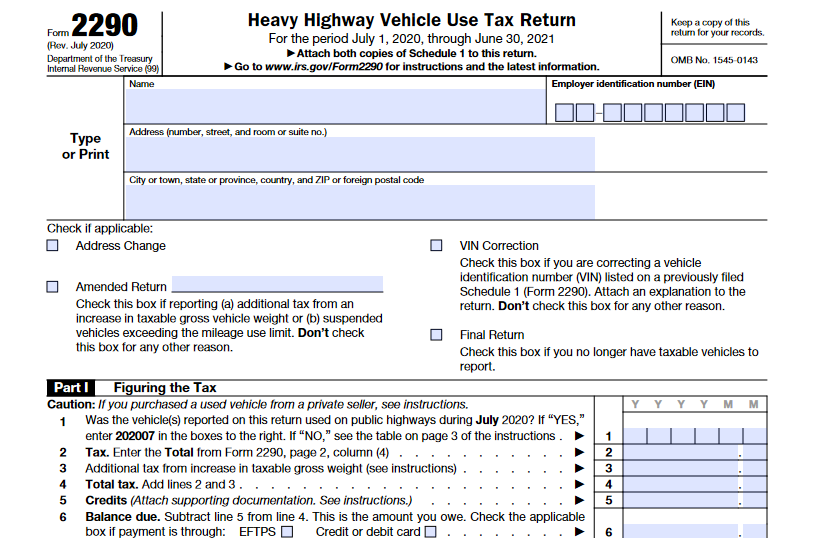

IRS 2290 Form - Overview

A 2290 Form must be filed if you operate a motor vehicle with a gross weight of 55,000 pounds or more. The 2290 Form also reports the amount of HVUT that you owe to the IRS. Once the IRS processes your return, it will send you the 2290 Schedule 1 which can be used as HVUT proof of payment to register your vehicle with any state DMVs or to renew your tags. The stamp is applied by the IRS with the date that actually indicates when the IRS processes your 2290 return.

Visit https://www.expresstrucktax.com/

efile/irs2290/ to learn more about Form 2290.

Information Required to File Form 2290 For 2023-2024

Tax Year

2290 Form requires information about your business and vehicle(s) including:

Business Details

- Business Name and DBA

- Address

Vehicle Details

- First Used Month (FUM)

- Vehicle Identification Number (VIN)

- Taxable Gross Weight Category

- Suspended Vehicle Information

Payment option

- EFW (Enter Bank Account Details)

- EFTPS (Schedule Payments)

-

Credit or Debit card (Select your card type

and Pay) - Check or Money Order (Mail 2290-V along with your Payment)

Visit https://www.expresstrucktax.com/

hvut/irs-2290-hvut-payment/ to learn more about IRS HVUT payments .

About our 2290 Form Online Filing Service

We are a leading e-file service provider of Form 2290 based out of Rock Hill, SC. We are offering a great product and superior service for filing 2290 online.

Our mission is to answer all of your queries quickly and effectively to guide you through the smooth Form 2290 filing process.

E-file Form 2290 with us and get your Stamped Schedule 1 or your money back.

Why Choose our 2290 Form Online

Filing Service?

Complete 2290 Form online filing

- 2290 Filing with the IRS

- FREE 2290 VIN Corrections

- Filing 2290 Amendments

- Claiming Tax Credits using Form 8849

Access to Schedule 1

- Receive Schedule 1 directly to your email

- Opt to receive through fax or postal mail

- We will send directly to your carrier

- Options to send it to additionals email

for free

Swift and Error Free Filing

- Inbuilt error check to ensure your returns are error-free

- Review Form Summary and make corrections before filing

- Re-transmit rejected return for free

US Based Customer Support

- Get the benefits of real support from

real people - We are providing support over phone, email, and chat

- We offer bilingual support in both English and Spanish

Visit https://www.expresstrucktax.com/

features/ to learn more about our Form 2290 e-filing features.

How to File Form 2290 for 2023-2024 Tax Period?

Add your business information

Choose first used month

Add your vehicle information

Pay & Transmit to IRS

Ready to File your Form 2290 Now?

File My 2290 Form NowDownload our Mobile and file 2290 Form on the Go!

As a trucker, you will be always moving somewhere. So, download the 2290 Form mobile app and file conveniently from your mobile device from any location. Receive your Form 2290 Schedule 1 via email within minutes!

Download the app now!

Helpful Resources

Ready to File Form 2290 for the 2023-2024 Tax Period?

Guaranteed Schedule 1 or your Money Back